March 8 marked Philip Hammond’s inaugural budget as chancellor. According to BBC News, the man himself summarised that the budget provides a “strong, stable platform for Brexit”, but how will the successful businessman’s announcements affect the future of business growth in the UK?

The top five takeaways for UK business owners, especially those in the technology and logistics sectors, are:

- Economic growth forecast raised for 2017 to 2%

- National insurance contributions will rise for the self-employed

- Investment in technical innovations and education

- Improving transport with the National Productivity Investment Fund (NPIF)

UK growth to business growth

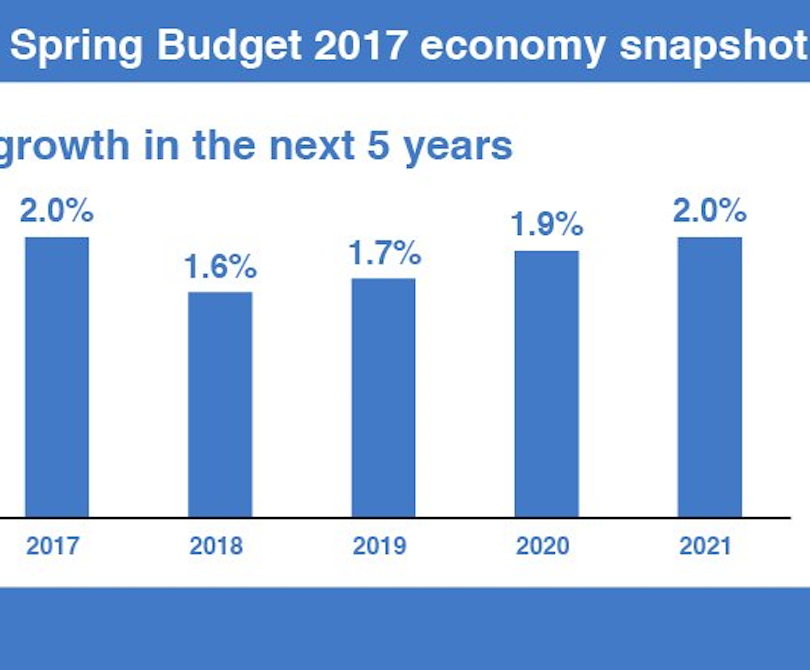

Despite fears by many since the Brexit vote, growth in the UK economy is going in the right direction. With growth picking up at the tail end of 2016 and employment peaking at a record 31.8 million people, the Office for Budget Responsibility (OBR) forecasts that the UK economy will grow by 2% in 2017. While this might slow again in 2018, it is expected to hit 2% again as soon as 2021.

Rise in National Insurance contributions for self-employed

The main rates of National Insurance contributions (NICs) for the self-employed are set to increase from next year. From April 2018, Class 2 NICs will be abolished and Class 4 NICs will rise from 9% to 10%. The following year they will increase by another 1%.

While this does not affect owners of larger corporations already embracing business growth, this is a salient issue for anyone looking to develop their business and consider becoming an employing business in the future.

In fact, SMEs have been described as the “biggest losers” in the 2017 budget by Chris Bryce chief executive of freelance association IPSE who also said: “If you are one of the hardworking self-employed people who face a significant increase on your tax bill, you might feel that the chancellor has it in for you.”

Data obtained from the Department for Business, Innovation & Skills shows that, at the start of 2016, the UK boasted a record 5.5 million private sector businesses, an increase of 97,000 on the previous year. During this period, the number of sole trader/self-employed businesses increased by 84,000 and they saw an annual growth of around +3%.

According to National Federation of Small Business Chairman Mike Cherry: “The National Insurance rise to 10% next year and 11% in 2019 should be seen for what it is – a £1bn tax hike on those who set themselves up in business. This undermines the Government’s own mission for the UK to be the best place to start and grow a business, and it drives up the cost of doing business. Future growth of the UK’s 4.8 million-strong self-employed population is now at risk. Increasing this tax burden, effectively funded by a reduction in corporation tax over the same period, is the wrong way to go.”

Technological innovations and advancements

We have heard rumblings about the dawn of improved broadband connections for UK businesses during the past few years but it looks like the government might have a treat in store to further improve the quality of mobile business communications with a new strategy to make the UK a world leader in 5G technology. Not only is there the promise of £200 million for local projects to build fast and reliable full-fibre broadband networks but there is also £16 million in the pipeline for a national 5G Innovation Network to trial 5G technology.

Also, part of the £270 million Industrial Strategy Challenge Fund will be used to advance research in universities and businesses in areas such as developing artificial intelligence that will work in extreme environments, like offshore energy. Speaking in anticipation of the budget announcements, Tech City UK chairman Eileen Burbidge said: “Any renewed commitment would be very welcome — particularly if it focuses on our unique strengths and growth areas such as AI, robotics, autonomous vehicles, or skills. That includes the ability to continue to attract foreign talent as well as to continue development of domestic skills to service those fields.”

What is more, the future looks brighter with regard to the skills-set shortage in the technology and construction industries. From 2019, new T-levels will be introduced and technical students, aged 16-to-19-years-old, will have a choice of 15 different routes. Training for these students will increase by more than 50% and all students will take part in an industry work placement as part of their chosen course. Maintenance loans for students doing higher-level technical courses at National Colleges and Institutes of Technology will also be available from the government.

Business growth with Brittain

We have supported more than 450 businesses in the UK and Europe during the various peaks and troughs of the economic climate. As such, the budget forecasts that 2017 will be another successful year for us and our clients.

To find out more about how Brittain’s B2B engagement specialists can offer high-level, high-value sales opportunities with the prospects you want to meet and how our expert team can support your strategic business growth plan going forward, contact us today.